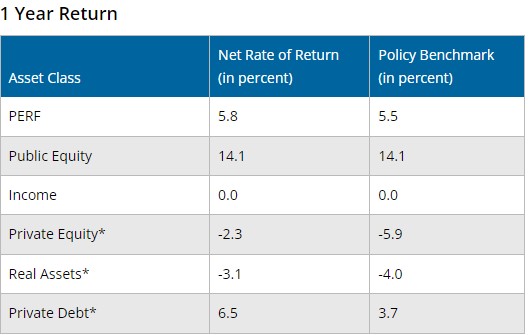

CalPERS reported a preliminary net return of 5.8% on its investments for the 12-month period ending June 30, 2023, the pension fund’s leaders said Wednesday. Assets as of that date were valued at $462.8 billion.

“Even with the economic challenges that still confront institutional investors, we have been able to maintain our focus on meeting the long-term retirement promises made to our members and their families,” said CalPERS Chief Executive Officer Marcie Frost.

The preliminary 5.8% net investment return stands in contrast to the prior fiscal year, when global financial volatility led to the fund’s first negative net return since the Great Recession.

When factoring in CalPERS’ discount rate of 6.8% — comparable to an assumed annual rate of return – and the 2022-23 preliminary return of 5.8%, the estimated funded status now stands at 72%.

Public equity investments outpaced all other asset classes in the new investment report, with an estimated 14.1% return in FY 2022-23. These assets comprise about 45% of the Total Fund.

“The resiliency of the stock market—particularly since the start of the calendar year—has created a solid base for the investment team to implement innovative approaches in delivering added value for our members in the coming years,” said CalPERS Chief Investment Officer Nicole Musicco.

Private debt, established as a unique asset class last year, outperformed the policy benchmark and reported a preliminary investment return of 6.5%.

The Total Fund’s second largest component, fixed income assets, finished the fiscal year flat. And two asset classes – private equity and real estate – reported a negative return.

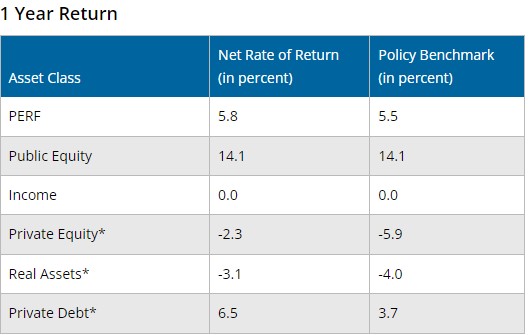

“Even with the economic challenges that still confront institutional investors, we have been able to maintain our focus on meeting the long-term retirement promises made to our members and their families,” said CalPERS Chief Executive Officer Marcie Frost.

The preliminary 5.8% net investment return stands in contrast to the prior fiscal year, when global financial volatility led to the fund’s first negative net return since the Great Recession.

When factoring in CalPERS’ discount rate of 6.8% — comparable to an assumed annual rate of return – and the 2022-23 preliminary return of 5.8%, the estimated funded status now stands at 72%.

Public equity investments outpaced all other asset classes in the new investment report, with an estimated 14.1% return in FY 2022-23. These assets comprise about 45% of the Total Fund.

“The resiliency of the stock market—particularly since the start of the calendar year—has created a solid base for the investment team to implement innovative approaches in delivering added value for our members in the coming years,” said CalPERS Chief Investment Officer Nicole Musicco.

Private debt, established as a unique asset class last year, outperformed the policy benchmark and reported a preliminary investment return of 6.5%.

The Total Fund’s second largest component, fixed income assets, finished the fiscal year flat. And two asset classes – private equity and real estate – reported a negative return.

*Private market asset valuations lag one quarter and are as of March 31, 2023.

While a single year’s investment returns are an important marker, long-term return rates provide a more comprehensive look at efforts to secure the future needs of public sector retirees. Total fund annualized returns for the five-year period ending June 30, 2023, stood at 6.1%, the 10-year period at 7.1%, the 20-year period at 7%, and the 30-year period at 7.5%.

The preliminary net return is an early snapshot of the CalPERS portfolio. The official Total Fund performance will undergo additional review over the next few months by outside experts, as well as by CalPERS investment and finance officials.

The ending value of the Public Employees’ Retirement Fund (PERF) for FY 2022-23 will be based on additional factors beyond investment returns, including employer and employee contributions, monthly payments made to retirees, and various investment fees.

The final fiscal year performance returns will be used to set contribution levels for the State of California and school districts in the 2024-25 fiscal year and for contracting counties, cities, and special districts in the 2025-26 fiscal year.